Whatever you’re selling, we're all over it

Whatever you’re selling, our innovative solutions keep businesses ahead, and help everyone in Australia stay on top of their money. That’s what eftpos is all about.

From cost effective debit transaction processing to tap to pay on mobile solutions,

there’s a range of smart eftpos solutions to explore.

Your money, well spent

eftpos solutions help everyone stay on top of their money, and on top of their budgets with

real-time balances.

Supporting business

Businesses can save on contactless debit card transaction costs by routing payments to the most cost effective channel.

Committed to security

A commitment to giving Australians the safest, most reliable ways to pay, while keeping data secure within the Australian Network.

Payment solutions made for business

Routing

With Least Cost Routing (LCR) you can direct contactless debit card payments through the most cost-effective payment processing network, enabling you to save on fees when a customer taps their debit card.

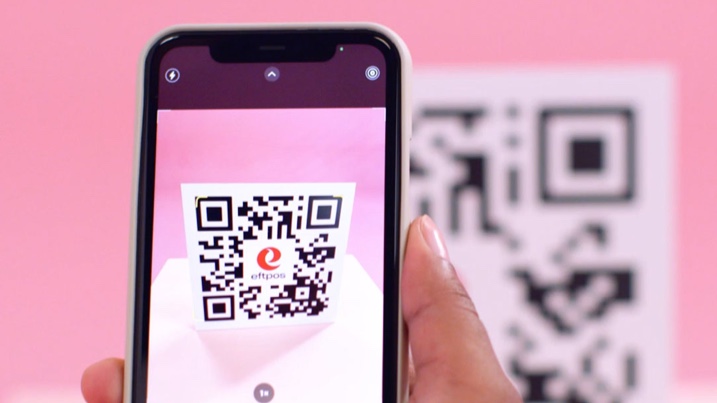

eftpos QR

eftpos QR will transform how you engage with your customers to help drive greater value and business growth.

Tap to pay on mobile solutions

Accepting payments has never been simpler. Accept contactless payments easily and securely on your mobile device.

Better together

Collaboration is at the heart of everything we do - whether it means talking to customers, co-creating with members or connecting with industry leaders.

We’re proud to collaborate with some of Australia’s leading brands on new and exciting payment solutions.

Latest eftpos

updates

Always here to help

- Check out our FAQs in the support section

- Check out the eftpos brand guidelines in the Brand portal

AP+ acknowledges the Gadigal People of the Eora nation as the Traditional Custodians of the lands on which we are based and pays our respects to Elders past, present and emerging. We recognise all Aboriginal and Torres Strait islander peoples ongoing connection to the lands and waters of Australia and thank them for protecting and for their pivotal role in the creation of this beautiful place. Always was and always will be Aboriginal Land.

©2023 Australian Payments Plus. ABN: 19 649 744 203 All rights reserved